Business Insurance in and around Arcadia

Calling all small business owners of Arcadia!

No funny business here

Your Search For Fantastic Small Business Insurance Ends Now.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, extra liability coverage and business continuity plans.

Calling all small business owners of Arcadia!

No funny business here

Surprisingly Great Insurance

Whether you own a drug store, a home cleaning service or a farm supply store, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

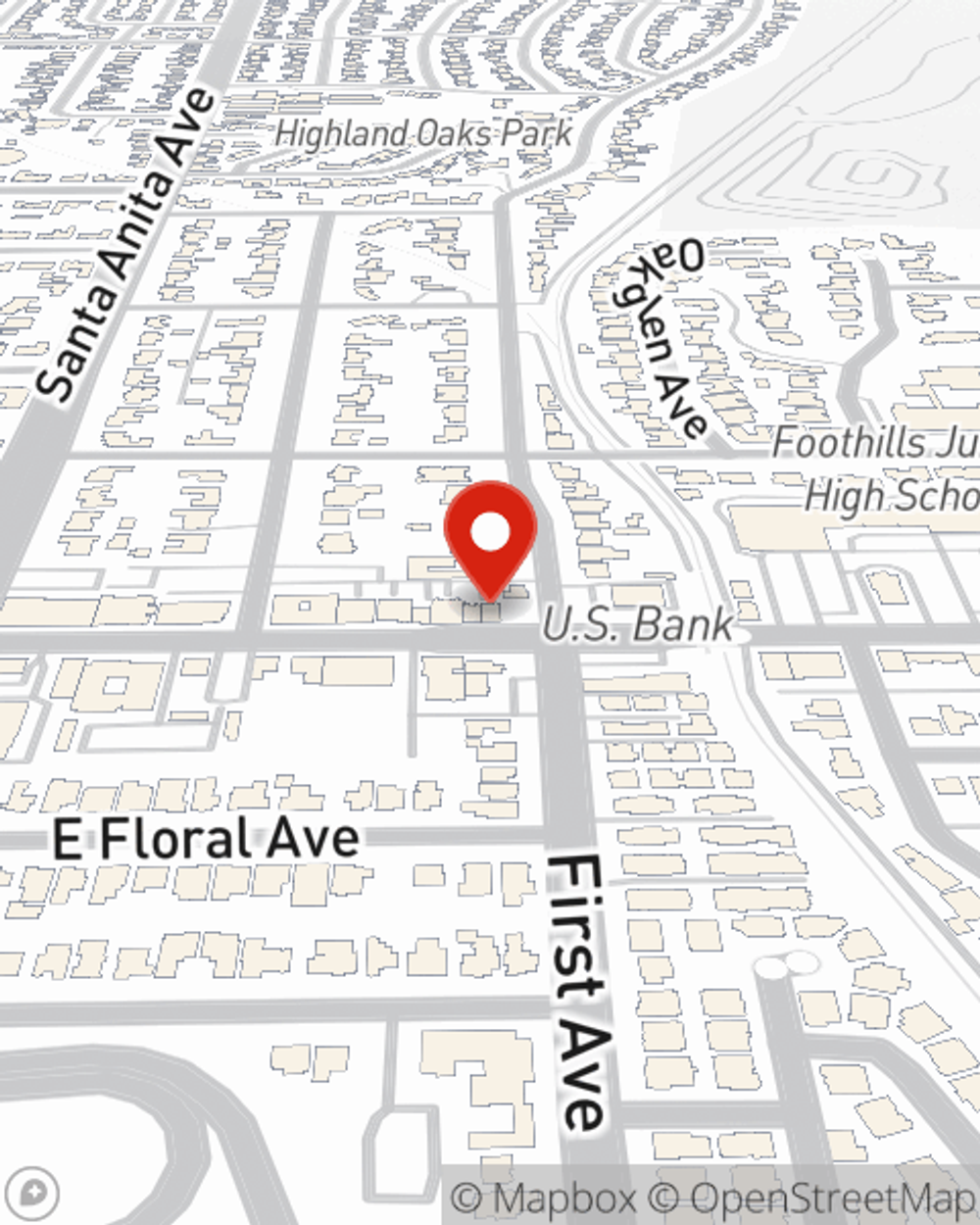

Reach out agent T.G. Metzger to consider your small business coverage options today.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

T.G. Metzger

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.